In an effort to help aspiring college students pay for school, President Obama and U.S. Education Secretary Arne Duncan have announced a pair of changes designed to streamline the Free Application for Federal Student Aid, or FAFSA, process.

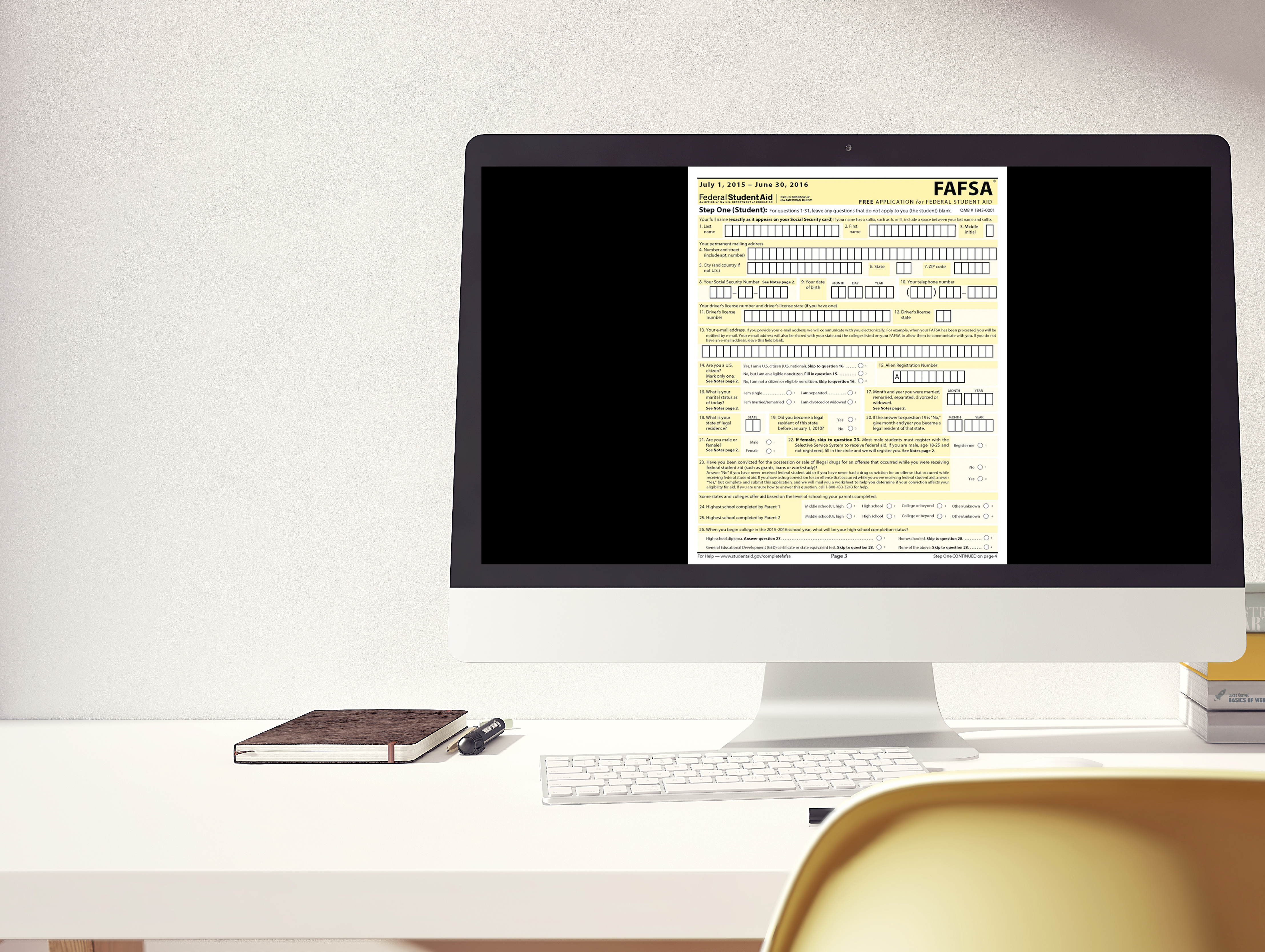

The FAFSA, as you may know, is the application used by state and federal governments to determine eligibility for Pell Grants and Stafford student loans, and the window to submit forms has traditionally opened in January.

But starting next year, students who are entering college in 2017 will be able to submit their FAFSA forms as early as Oct. 1, 2016, or three months sooner. Moreover, for the first time, applicants will be allowed to use their prior-year tax forms instead of estimating their family income and updating the figures later in the year.

So, to summarize, students entering college in 2017 can submit their FAFSA forms as early as October 2016, based on their 2015 income tax information.

The current window to file FAFSA documents – January through March – has been less than ideal for a couple reasons. Not only is it a time when scores of students have applied for college but haven’t yet been accepted, it’s also when many families are waiting for their income tax documents.

The current window to file FAFSA documents – January through March – has been less than ideal for a couple reasons. Not only is it a time when scores of students have applied for college but haven’t yet been accepted, it’s also when many families are waiting for their income tax documents.

Allowing students to apply for financial aid a few months earlier should reduce the anxiety that comes with committing to a school before you know how much tuition assistance you’re eligible to receive. And it just makes sense to use your most recent income tax information, particularly if the FAFSA forms are being submitted sooner.

Note that both of these changes will be permanent, starting with the 2017-18 FAFSA forms. Meanwhile, the 2016-17 applications are expected to be released on Jan. 1. (And yes, both will be based on 2015 income tax information.)

For more information, check out the FAFSA changes information sheet by the U.S. Department of Education and this White House fact sheet on the president’s plan for early financial aid.